1. What is Insured Nomads?

Founded in 2019, Insured Nomads is a company based in Birmingham, Alabama, USA. It provides a wide range of products that cover global and regional health insurance and travel insurance.

Insured Nomad’s plans cater to the needs of remote workers, travelers, expats, and anyone living away from their home country. It also provides a range of tech-enabled solutions and support for the health, well-being, and security of its users.

Insured Nomad is a signatory of the UN Global Compact with a commitment to integrity and sustainability. The company also donates to Not For Sale, a global organization fighting modern slavery.

2. Overview of Insured Nomad Services

Insured Nomads’ offerings include comprehensive health and travel insurance for remote workers and frequent travelers.

Here’s a close look at their coverage highlights under their two main offerings:

2.1. Health Insurance

Insured Nomads’ Health Insurance plans are tailored for those that travel outside their home country for more than six months each year. It considers all long-term healthcare needs when staying in a foreign country, covering emergency, routine, preventive, and chronic health requirements.

It includes the following:

- Inpatient care: hospital stays, surgery and related care, oncology, and organ transplants

- Outpatient care: physician consultations, diagnostic tests, alternative and complementary treatments, ER or urgent care

- Mental health: 24/7 mental healthcare hotspot, virtual mental health support in more than 60 languages, substance abuse support

- Assistance and more: ambulance transportation, vaccinations, preventative screenings, prescription drugs, maternity care, vision care, dental care

Health Insurance comes in three packages that users can customize for their desired coverage per person, deductible, and more. All packages come with a 12-month INC membership. The pricing for Health Insurance starts at $225 per month.

The basic health insurance package, Connect, provides maximum medical coverage of $500,000. It starts at $224/month.

Connect One provides maximum medical coverage of up to $1,000,000 per policy, starting at $256/month.

Connect Three comes with the highest medical coverage of up to $3,000,000 at $256/month.

2.2. Travel Insurance

Insured Nomads’ Travel Insurance provides coverage for non-medical situations. It comes in two main types of plans: the World Explorer & World Explorer Multi.

The pricing for these plans is customizable based on age group, duration, and other factors. It starts at $86 per month.

Insured Nomad also has two other insurance plans, but one of those is exclusively for US residents, and the other is for travelers going into areas of conflict, warzones, or hotspots. So we won’t be covering those in this review.

2.2.1. World Explorer

The World Explorer plan is for travelers seeking coverage on a single trip between seven and 365 days. It provides benefits of up to $2 million and can be extended once for an additional six months.

However, the total duration of coverage is only 90 days per trip for travelers visiting the USA under this plan.

It covers medical and personal accidents, personal liability coverage, repatriation costs, and unexpected costs (such as those accompanying accidental death while abroad).

2.2.2. World Explorer Multi

This plan is ideal for seasoned travelers who plan multiple short trips in a year and return to their home country in between. Moreover, you can cut a trip short, return home, and continue your journey without voiding the policy.

The World Explorer plan is for travelers seeking coverage on a single trip between seven and 365 days. It provides benefits of up to $2 million and can be extended once for an additional six months.

However, the total duration of coverage is only 90 days per trip for travelers visiting the USA under this plan.

It covers medical and personal accidents, personal liability coverage, repatriation costs, and unexpected costs (such as those accompanying accidental death while abroad).

2.2.3. Medical

You are covered for 24-hour emergency medical care, acute onset of a pre-existing condition, emergency dental treatment, and COVID-19. The medical benefits cover expenses between $250,000 and $2 million.

2.2.4. Transportation and Security

Transportation coverage includes local ambulance transport, bedside visit, natural disaster accommodations, evacuation, trip interruption, return of minors, repatriation, and more such emergency transport.

It also provides access to alerts and a 24-hour response center.

2.2.5. Property and Miscellaneous

This includes coverage for trip cancellation, flight delays, lost luggage, and cell phone coverage.

There’s also coverage for high-risk sports, adventure, and marine activities, such as bungee jumping, scuba diving, and more. Make sure you check their covered list of sports before you buy the add-on, as the list is quite comprehensive.

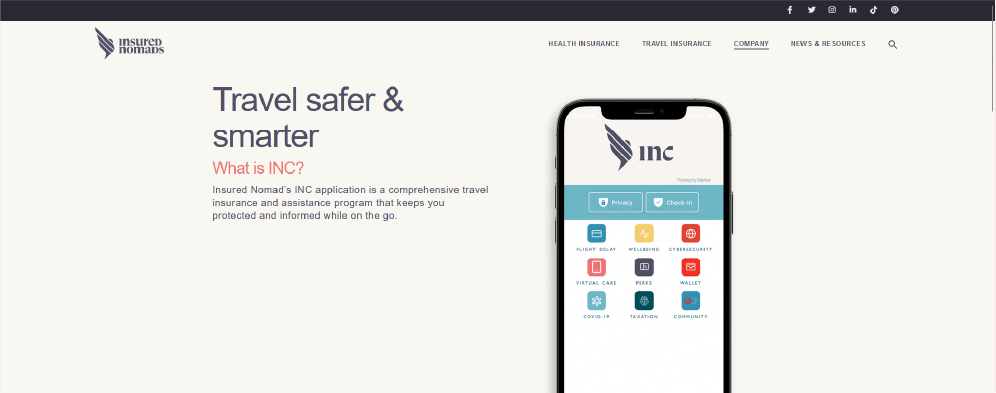

3. Insured Nomads Community (INC) Tools

The travel and health insurance plans also provide one-year access to the Insured Nomads Community (INC) app and its features. This is an exclusive app that provides users with some non-travel insurance benefits.

The best part is, users can avail of these benefits even if they never file a claim.

Here are some of its key feature categories and what’s offered under each one:

3.1. Security Features

The INC app provides users with geo-location alerts, a 24/7/365 PANIC button, cybersecurity, evacuation and relocation support, and more.

Travelers can also access taxation and currency-related information from within the INC app.

3.2. Health Features

Some of the health benefits offered with INC include COVID-19 information, medical emergency support, visa and vaccination requirements, speech therapy sessions, and mental health counseling and assessments.

The best feature under health offerings is telemedicine, which ensures all travelers can access basic healthcare support from anywhere in the world.

3.3. Community Features

Community features are some of the best benefits of the INC membership. You can access exclusive offers from businesses and community recommendations from other Insured Nomad users. Users can chat, meet up, and check in with other community members.

The app lists information like cultural traditions, holidays, country demographics, and infrastructure to help travelers create the best possible itineraries.

3.4. Comfort Features

These include perks such as flight delay lounge access and travel delay reimbursement with information for vulnerable groups.

Overall, the INC app is a highly valuable add-on for all kinds of travelers. It can store data offline, so you’re never without guidance even when you don’t have access to the internet.

4. Why Should You Consider Going For Insured Nomads?

Here are the main reasons to choose Insured Nomads over competitor products:

- Comprehensive travel and health insurance packages

- Competitive pricing

- Insured Nomads Community app

- Add-on coverage for high-risk sports

5. Limitations of Insured Nomads

Insured Nomads’ plans have a few limitations. You can go through them below and decide if they outweigh the benefits or not:

- Relatively expensive

- Add-on features, such as extreme sports coverage, add to the plans’ total cost.

- Slow app

- Some customer reviews mention the lack of live customer support.

6. Siwom’s Final Verdict

Our Insured Nomads review makes it clear that this is a good travel insurance service for travelers who need a little bit of everything. It’s fairly easy to use and offers competitive pricing options for its range of features.

The INC app is an excellent addition, which surprised us with its many benefits, like mental therapy sessions, airport lounge access, and cybersecurity.

The claims assistance process is pretty straightforward, and the processing takes up to 30 days. You also get up to 60 days to file a claim, so that’s helpful in instances when you cannot file a claim immediately.

Customer support isn’t available 24/7, which is a significant disadvantage.

Overall, Insured Nomads provides excellent coverage and valuable features that any frequent traveler will love. It may be a bit expensive, but given its many features, we wouldn’t mind paying a little extra.

7. FAQs

7.1. How does Insured Nomads' pricing compare to other insurance providers?

Insured Nomads’ pricing is a bit expensive in comparison to competitor products.

7.2. Are there any limitations or exclusions to be aware of when using Insured Nomads’ insurance plans?

Insured Nomads does not cover people above 74 years of age. It also has some strict rules regarding coverage for lost or stolen baggage. Review all terms of your plan so you won’t be frustrated trying to claim coverage for something not included in the package.

Interested in Virtual Team Building Events?

Interested in Virtual Team Building Events?